Most traders use pennants in conjunction with other chart patterns or technical indicators that serve as confirmation. Or, the consolidation may occur near trendline resistance levels, where a breakout could create bear pennant pattern a new support level. With a bullish pennant, a long position must be opened after the breakout of the pennant’s upper border. Stop loss should be placed just above the crossover of the pattern borders.

- Bears generally have a reputation for being very loyal and devoted to their partners.

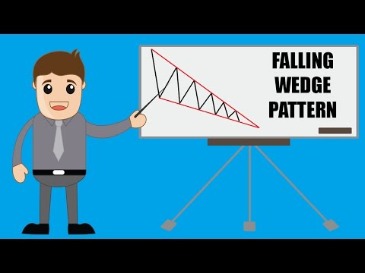

- The bullish and bearish pennants are continuation patterns that both indicate a pause in the current market trend.

- However, the bear pennant breakout direction also depends on the shape of the triangle and the length of the flagpole.

- As such, traders should look for opportunities to go long once price action reaches the bottom.

And here’s another example from the crypto sphere — formed on the BTC/USD candle chart. The Bullish Bears team focuses on keeping things as simple as possible in our online trading courses and chat rooms. We provide our members with courses of all different trading levels and topics.

Pennant Trading Strategy 2: Trading based on Pattern Height

This breakout can be a strong move, so you’ll want to use a tight risk-to-reward ratio to maximize your profits and minimize your losses. You should notice that the pattern is most reliable when the consolidation period lasts between 2 and 3 weeks. When this happens, there is a high probability that the prevailing downtrend will continue as the support level has been broken. This signals a pessimistic outlook on the market, and often leads to further declines after a breakdown from the pattern. From beginners to experts, all traders need to know a wide range of technical terms.

- A bullish pennant pattern begins with a bullish candlestick, creating a flagpole and then consolidating into a standard.

- With this comprehensive guide, you’re always prepared for market volatility, and you’ll never regret missing out on any highly profitable trades again.

- My students tell me that there is a lot of confusion around this chart pattern, so I thought I’d put together a guide on how to identify a bearish pennant breakout.

- At the end of the initial move lower (the flagpole), the price action rebounded near the levels of the previous swing low – the horizontal support.

Look for price to fall out of the pennant to confirm bearish breakdown. The bearish pennant pattern is a downtrend continuation chart pattern. The formation of this pattern occurs after an active price decline. Pennants form after a deep and robust correction and have a clear direction for the breakpoint. As for what they are not, triangle patterns are continuation patterns, while pennant patterns act as reversal signals.

What Is a Bearish Flag Pattern? Bear Flag Meaning

In other words, the trend continues to develop in the same direction after a short-term accumulation. Bears generally have a reputation for being very loyal and devoted to their partners. This is especially true if the bear feels neglected or unloved by its partner or if there are problems with communication that cannot be resolved. Additionally, if one of the bears has changed significantly since they first got together, it can lead to incompatibilities that can’t be overcome, resulting in a breakup. Pennants will give you trading opportunities in many different forms (Ascending, Descending, etc). Put simply, a Pennant is a small pattern and a short-lived consolidation.

How to trade the flag pattern – FOREX.com

How to trade the flag pattern.

Posted: Thu, 11 Aug 2022 07:00:00 GMT [source]

These patterns are commonly seen after a strong bear market trend and form a reversal point. On the other hand, triangle patterns do not require a strong movement preceding the way and can be seen in any market environment. A take profit must be set at a distance equal to the height of the flagpole or the pennant itself. Have you ever wondered why pennant patterns are so prevalent in technical analysis? This blog post will cover the bear pennant pattern and its relevance in technical analysis.

How to Trade Crypto With a Bear Flag Pattern

In stock trading, traders look for a break in the support level of the pennant to signal a reversal from an uptrend to a downtrend. The bear pennant pattern can be interpreted as a bearish continuation pattern. It forms when market participants are bearish on an asset and start to sell it in bulk. As the bearish sentiment intensifies, the asset price breaks support levels and declines sharply. When the selling pressure increases, the asset’s cost moves lower until it approaches rock bottom. At this point, traders stop selling and start buying, resulting in a rally that tests resistance again.

In a bearish pennant, strong negative sentiment causes a market to plummet lower (forming the pole). The sellers that have pushed its price down might then back off and take profit, while bulls sense the potential for a bounce back. In a bullish pennant, strong positive sentiment causes a market to spike higher (forming the pole). The buyers that have pushed the market higher then might back off and take profit, while bears sense the potential for a retracement. This parity between supply and demand causes its price to consolidate.

What’s happening in a bearish pennant?

As in the case of bullish pennants, the profit target is set at the height of the flagpole or the entire pattern. Many traders struggle to identify bear pennant patterns because the pattern may not show any apparent range expansion. Instead, other signals and needles must be used with the bear pennant pattern to confirm its validity. One of these indicators is stop-loss orders, which should be used extensively, given that the way may not show significant range expansion.

The bullish pennant pattern in Forex means an uptrend continuation. In some cases, with a protracted downtrend, the pattern signals a bearish-to-bullish reversal. Lastly, futures traders watch for price action to break through its support level and follow through with further downside momentum before entering into short positions. All in all, bear pennants can be traded on forex, futures, and shares if one pays attention to their patterns and looks for confirmation of reversals. A https://g-markets.net/ is an essential indicator of bearishness in the market. As the name suggests, a bear pennant pattern has a contracting triangle rather than a rectangle shape.

The pennant, after a sharp move in price, indicates that there is likely to be a breakout and continuation in the direction of the initial move. In this article, you will learn how to recognize Pennant chart patterns, what they mean, what causes them and, most importantly, how to use them to place more effective trades. This includes being aware of the potential for false breakouts, as well as the bearish pennant reversal probability. Your stop loss should be placed just above the upper trendline of the pennant, and you can take profit at the next support level below the breakout point. The formation is complete when the price action breaks below the lower trend line of the pennant. A breakout to the downside occurs when prices break below the lower trendline of the flag formation.

Bearish Pennants are continuation patterns that occur in strong downtrends. They always start with a flagpole – a steep drop in price, followed by a pause in the downward movement. The bear pennant pattern is a chart pattern that is recognized as a downtrend in the stock market. The bear pennant pattern consists of a series of lower highs and lower lows. This pattern can be used to spot potential support and resistance levels.

How to Trade Bear Pennant Patterns

In this article, we will discuss what the bear flag chart pattern looks like, how to identify it, and what trading strategies you can use when trading it. A trader may reference a chart set up that looks like a flag or a pennant. They are both have a similar shape and easy to mix up, it could look like the other. Bearish candlesticks form the pole, followed by consolidation, then a fall downwards. You can get a potential target by taking a measurement from the previous breakout creating the flag pole, then projecting it from the bottom of the bear pennant.